By Chase Castle

chase@corridorbusiness.com

As cars become increasingly automated with driver-assisting technologies, auto insurance companies are likely to experience a shift in liability from drivers to automakers, which could have a lasting impact on both driver premiums and the industry’s funding model.

That was just one of the challenges related to the rise of autonomous vehicles identified by industry experts during an April 17 panel, hosted by the University of Iowa’s Public Policy Center.

Among them was Eric Williams, an attorney with the Insurance Institute for Highway Safety, a nonprofit research group, who said the potential for drivers having a diminished role in determining liability for an accident will largely depend on how automated a vehicle is.

With a wide range of cars now offering some level of driver assistance, the National Highway Traffic Safety Administration (NHTSA) has identified five levels of vehicle automation. At Level 0, the driver controls all the vehicle’s major functions. At the other end of the spectrum is Level 4, where the vehicle performs all critical driving functions without any active input from the driver – a classification Mr. Williams said could seriously impact how auto insurers evaluate and price drivers’ premiums.

“If you’re talking about higher levels of automation where there’s no steering wheel, there’s no pedals … the manufacturer would have greater responsibility and therefore lower accountability for the driver,” Mr. Williams said.

“That doesn’t mean that if the autonomous vehicle does get into an accident, that the police officer [won’t] still issue the driver a citation,” he added. “But I think as we start seeing more of those with automation, the liability question … will probably shift.”

According to the Insurance Information Institute, auto insurers nationwide collected about $107.4 billion in driver premiums in 2013. In 2012, the most recent data year available, Iowa was the third least-expensive state in the country for auto insurance behind Idaho and South Dakota, with consumers annually paying an average of just over $560.

Mr. Williams said about 3-4 percent of those premiums make up auto insurance companies’ profits, which poses additional concerns for insurers about the expense of repairing or replacing automation technology. Paid out claims account for about 66 percent of drivers’ premiums, he said, while overall operating expenses account for about 30 percent.

“I point that out because any small shift in the severity of the cost of repairing a vehicle will have a large impact on how much they end up paying out [in claims],” Mr. Williams said.

He noted that any change in insurance industry standards for automated vehicles is likely to happen slowly. As was the case with the implementation of anti-lock brakes, for example, it historically takes about 30 years to reach the point where at least 95 percent of vehicles have that feature.

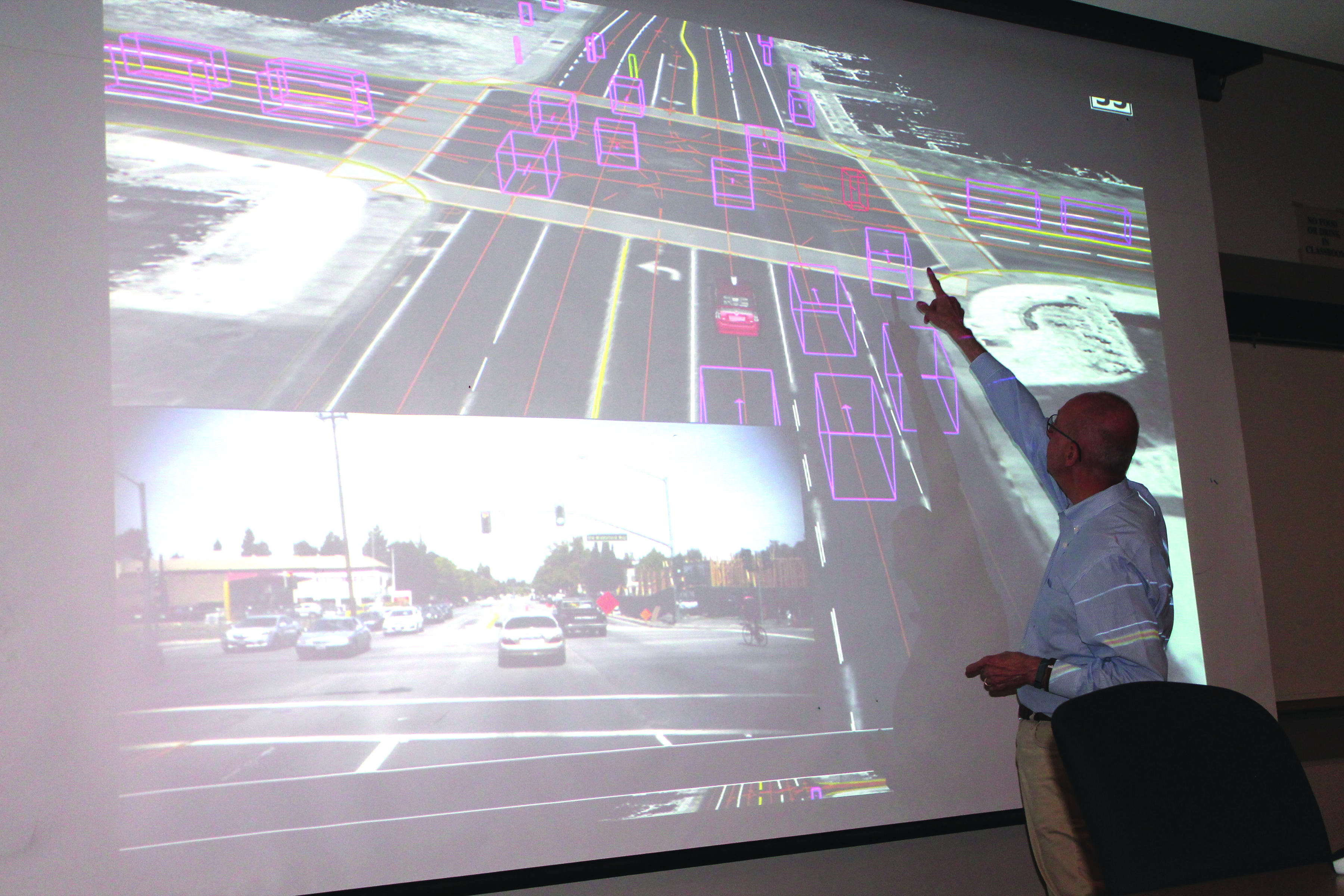

Ron Medford, the safety director for Google’s self-driving car project, was also was among the industry experts visiting Iowa City this month. Despite the relatively long road to reaching market saturation, Mr. Medford said automated cars will hit public roadways sooner than most expect.

“It’s not so far away,” Mr. Medford said. “I think it’s a lot closer than people are speculating now.”

In fact, at least one car with newly developed safety automation features will be on the roads of Iowa City this summer. Dan McGehee of the UI’s Transportation and Vehicle Safety program said the university has purchased a 2016 Volvo XC90 from Junge Volvo in Cedar Rapids through a consortium with Volvo. The Level 2 automated vehicle, scheduled for June delivery, contains two “world-first” automated safety features according to the carmaker: Auto-brake when the SUV is turning in front of an oncoming vehicle, and a mechanism to prevent accidental road departure.

Several cities in the Corridor already have voiced support for using local roads for automated vehicle research. Iowa City, Coralville, North Liberty and Johnson County all have approved declarations supporting automated vehicle research on their roads, which would likely be coordinated with researchers at the UI’s Public Policy Center and the National Advanced Driving Simulator at the UI’s Research Park.

“We are more than willing to cooperate to get through those hoops that may arise from using this type of technology on public roadways,” said Coralville Mayor John Lundell, who visited Google’s headquarters in Mountain View, Calif. for a training program aimed at helping city officials implement policies supporting automated vehicles. “We are a willing participant.”

Mr. McGehee said that in addition to support from local elected officials, a new interchange on Interstate 380 being studied by IDOT staff could present another research opportunity. While the proposed interchange at Forevergreen Road must be approved by the Federal Highway Administration, funding for the estimated $20-25 million project has been approved for the 2019 fiscal year. Mr. McGehee said incorporating highly reflective paint into the designs and “salient” signage capable of being read by automated systems would make the highway more conducive to automated driving.

“The broader question we’re asking is, if we’re going to spend considerable amounts of money modernizing these resources, it doesn’t take a large amount to design them with automated vehicles in mind,” he said.