By Dave DeWitte

dave@corridorbusiness.com

Rockwell Collins became part of United Technologies Corp.’s new Collins Aerospace Systems division on Nov. 26, with a message to the industry that “together, we are redefining aerospace.”

It’s a bold message that could easily be dismissed as exaggeration, except for the fact that Collins Aerospace will have more resources than the vast majority of its rivals, and has a clear vision for advancing the industry through more “intelligent” aircraft.

With 70,000 employees and $23 billion in pro forma sales, the company will be more global than Rockwell Collins, and more heavily focused on commercial markets. About 75 percent of its business will be commercial and 25 percent military, compared to a roughly even split between the markets at Rockwell Collins.

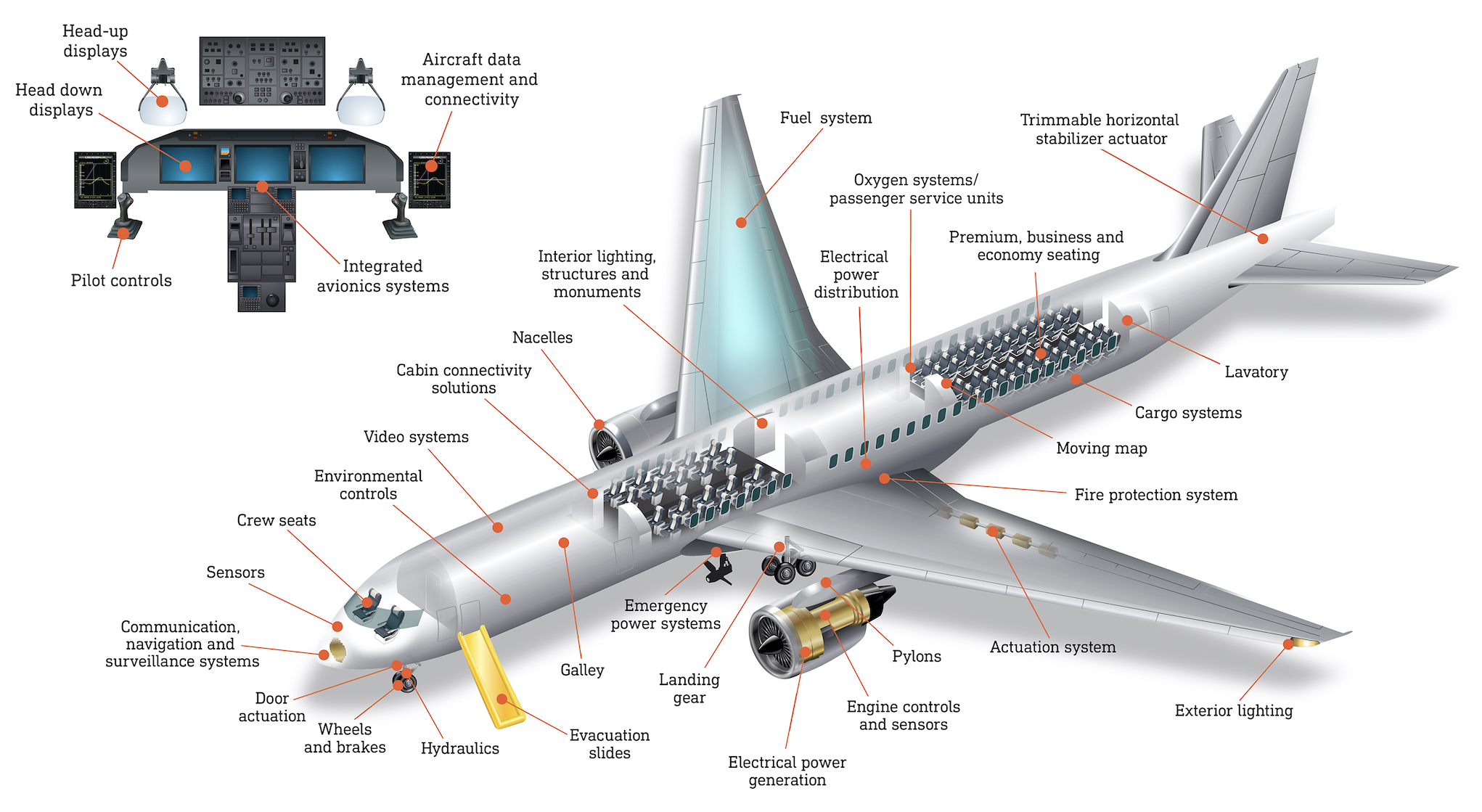

“Consider the future of intelligent aviation and the defense ecosystem,” Collins Aerospace Systems CEO Kelly Ortberg wrote in a web post introducing the new company. “Few companies touch more of the components of this ecosystem – or have more opportunities to architect intelligent, interconnected systems that design-in performance and design-out cost than Collins Aerospace.”

Mr. Ortberg pointed to a “new aviation data-driven business model” that will enable airlines to access their data via Collins Aerospace’s global networks. Generated from sensors built into components and connected to a network, that data promises to empower airlines to find savings through new insights, such as when a jetliner should slow its speed to conserve fuel or avoiding flight cancellations by receiving early indications that an aircraft component needs to be replaced.

In defense markets, Mr. Ortberg said Collins Aerospace will have broad capabilities spanning airborne intelligence, surveillance and reconnaissance, blended live and virtual training, and ground-air networks customized to mission needs.

Rockwell Collins brings to Collins Aerospace its widely recognized strengths in cockpit electronics, air-to-ground networks and flight training systems, while UTC brings an array of systems from its prior acquisitions of Goodrich Corp. and Hamilton Sundstrand.

“With the formation of Collins Aerospace, we would be better positioned to meet evolving customer requirements for aerospace systems that are more electric, more intelligent, more integrated and more connected,” UTC Chairman and CEO Gregory Hayes told stock analysts after the deal closed.

Mr. Ortberg last month rattled off a list of new commercial, business, military and rotary aircraft that are being supplied by Collins Aerospace in an interview with FlightGlobal magazine, covering most of the high-growth opportunities in the industry. Highlights include the Airbus A220 and A320neo, the Boeing 737 MAX and 777X, and the Embraer E-Jet E2 series.

“It’s really a broad portfolio offering for everything that flies,” he told the magazine on Nov. 27, “Day One” of the new Collins Aerospace division.

As Mr. Ortberg and Collins Aerospace President Dave Gitlin were sharing their vision with the trade press, a larger UTC story was grabbing headlines in the mainstream media. UTC simultaneously announced plans to split up into three companies over the next two years in a transaction that is expected to give shares of each new company to current shareholders without tax liability.

Collins Aerospace will be paired with Pratt & Whitney, UTC’s aircraft engine business, in a new United Technologies Corp. focused exclusively on aerospace. Going their own way under different names will be Otis, UTC’s elevator, escalator and moving walkway business, and Carrier, a global provider of HVAC, refrigeration, building automation, fire safety and security products.

The plan means Collins Aerospace will no longer be part of a widely diversified global conglomerate, although it will be part of the world’s largest aerospace-focused manufacturer, with the technical breadth, purchasing power and negotiating strength to withstand plans by aircraft manufacturers to insource more components of their aircraft.

A subsequent announcement by French aerospace and defense giant Safran provided a reminder of how consolidation is changing the world of aerospace components. Safran shareholders had just approved its acquisition of France’s Zodiac Aerospace, one of the largest and oldest aerospace component manufacturers in the world, with sales of more than $5.9 billion. Safran offered a French vision of the future, saying it plans to overtake UTC in the next 15 years to become the largest aerospace components supplier, fueled by the addition of Zodiac and accelerated R&D spending.

UTC’s split-up marks a drastic turnabout for the industrial conglomerate, and was portrayed by Mr. Hayes as a way to maximize value by enabling each of the three businesses to make independent decisions about how best to allocate capital and serve their markets. It was also a powerful response to activist shareholders like billionaire Daniel Loeb of the hedge fund Third Point, who said in a letter to clients in May that breaking up the company could unlock $20 billion in shareholder value, excluding breakup costs.

Wall Street was unimpressed by the split-up plan, however, with UTC’s share price tumbling 6.5 percent on Nov. 27 – an otherwise strong market day – after the split was announced. The company subsequently underwent a debt downgrade by Standard & Poor’s. Most investment houses have held their ratings steady on UTC’s stock, which hasn’t risen significantly since the acquisition was announced 14 months ago.

The issue appeared to be one of near-term concerns about UTC’s prospects rather than long-term doubts. Among them: plans to hold off on significant stock repurchases to conserve cash during the organizational split, uncertainty over how long the split will take and UTC’s lowering of near-term cash flow projections for the former Rockwell Collins business.

A bigger risk that was widely discussed going into the $30 billion Rockwell Collins deal was whether UTC can deliver on its claim that the acquisition will yield $500 million in annual cost savings in the fifth year after the deal. Cost saving projections were a big part of the financial justification for the merger, and yet are one of the biggest areas where acquisitions often fail to live up to their promise. They are also an area of concern for the communities in which Collins Aerospace operates, posing uncertainty over how many job reductions it will take to meet that target.

Before the Nov. 26 closing, UTC and Rockwell Collins were already hashing over where the savings would come from, primarily in reducing supplier costs through joint volume purchasing, and through reduced sales, general and administrative (SG&A) expenses.

In a Nov. 27 conference call, UTC CFO Akhil Johri told stock analysts that UTC and Rockwell Collins each fielded “clean teams” that were meeting before the acquisition closed to identify promising areas for cost synergies, in particular looking at how much each pays its suppliers for certain commodities. The exercise has enabled UTC to see how much could be saved by moving purchases to the lower-cost supplier and negotiating better prices for increased volumes, Mr. Johri said.

“We feel very good about the total $500 million synergies number that we have talked about,” Mr. Johri said. “If anything, we feel better about the revenue synergies, which we have not factored into our business case. So I think, all in all, it feels really good.”

Mr. Johri also expressed confidence that SG&A can be lowered, saying the total number of divisions in the two companies will be declining from 10 to six.

“That means you free up some G&A,” he said. “You don’t have as many general managers. You don’t have as many finance managers. All that generates savings that are part of the synergy goal we have.”

After the closing, Mr. Hayes told analysts the company is expecting the Rockwell Collins acquisition to add 15-20 cents per share to earnings in fiscal 2019.

The local outlook

Collins Aerospace spokeswoman Pam Tvrdy-Cleary said the company is “still very committed to Iowa, with two [of six] business units being in Iowa.” The company has no current plans for workforce reductions, she said, and the divisions based here gained some product lines that were not part of Rockwell Collins. Those include sensors, ejection seats and space suits.

In the local business community, “people are just relieved that the job count and employee base is still here,” said Doug Neumann, executive director of the Cedar Rapids Metro Economic Alliance.

While the Economic Alliance likes to promote the corporate headquarters located here, Mr. Neumann said he doesn’t expect the loss of Rockwell Collins as the only local Fortune 500 headquarters to be a great blow. He said there hasn’t been any word of negative impacts on local suppliers from the ownership change.

“There’s plenty of evidence the influence, leadership and community impact of Collins Aerospace is not going to diminish,” Mr. Neumann said.

Collins Aerospace’s avionics unit, led by Kent Statler, provides commercial and defense avionics, cabin management and content systems, information management systems and services, aircraft sensors and fire protection and safety systems.

Mission Systems, led by Phil Jasper, serves defense markets. Its products include systems for communication, navigation, electronic warfare, nuclear command and control, simulation and training, space, intelligence and surveillance, as well as ejection seats and optical products.

A third Collins Aerospace business unit will also be run by a former Rockwell Collins executive. Dave Nieuwsma, who led Information Management Services, is now in charge of the company’s Interior Systems business, based in Winston-Salem, North Carolina.

Collins Aerospace has established an executive office in West Palm Beach, Florida – not officially called the headquarters – with a staff of about 30 under Mr. Ortberg and Mr. Gitlin, Ms. Tvrdy-Cleary said. Few of the Rockwell Collins leaders from Cedar Rapids have relocated, and Collins Aerospace is striving to minimize relocations as it integrates Rockwell Collins.

UTC’s corporate headquarters is in Farmington, Connecticut.

In total, Collins Aerospace employs about 9,000 in Iowa, most of them in Cedar Rapids. Iowa locations outside Cedar Rapids include Bellevue, Coralville, Decorah and Manchester.

The sale of Rockwell Collins marks its second buyout by a large industrial conglomerate. Founded in 1933 by inventor, entrepreneur and radio engineer Arthur Collins, the company was sold in 1973 to Milwaukee-based Rockwell International. It was spun off as an independent company in 2001, ending Rockwell International’s era of industrial diversification.