By Dave DeWitte

dave@corridorbusiness.com

Air freight volume is swelling with growing demand for overnight delivery in the e-commerce world, expanding opportunities for the Eastern Iowa Airport.

Through the first nine months of the year, enplaned air cargo volume at CID – meaning shipments originating at the airport – was up more than 21 percent to 48.1 million pounds. That follows a big gain in 2017 and a modest one in 2016.

Among the three freight companies using the airport, United Parcel Service (UPS) has been moving the largest volume. However, DHL Express, the smallest of the three by volume, has been generating the biggest gains, with its cargo up 79 percent through the first nine months of the year compared to the same period of 2017.

With demand straining the airport’s current cargo operations, located next to the passenger terminal, CID is launching a $10.3 million project to relocate and expand those operations to a spot adjacent to the FedEx facility on the west side of the airport.

The project will expand the cargo apron used for loading and unloading aircraft, and include construction of a connecting taxiway, allowing for a joint-use cargo center for the three carriers.

“Cargo’s doing really well,” Airport Director Marty Lenss said in a recent interview with the CBJ Editorial Board. A big part of the growth is due to the explosion in online commerce, and particularly the demand for overnight parcel delivery. He said CID is seeing a larger share of that growth than the other large airports in Iowa.

CID currently handles 45 percent of Iowa’s total air cargo.

“Air cargo for Waterloo comes in here, for Dubuque comes in here, for a lot of Moline comes in here … and of course Iowa City and Cedar Rapids, so there’s a big regional footprint that we serve,” Mr. Lenss said.

Air cargo also fans out east-west from CID along Interstate 80 and north-south on I-380 to reach a surprisingly high percentage of Midwestern customers.

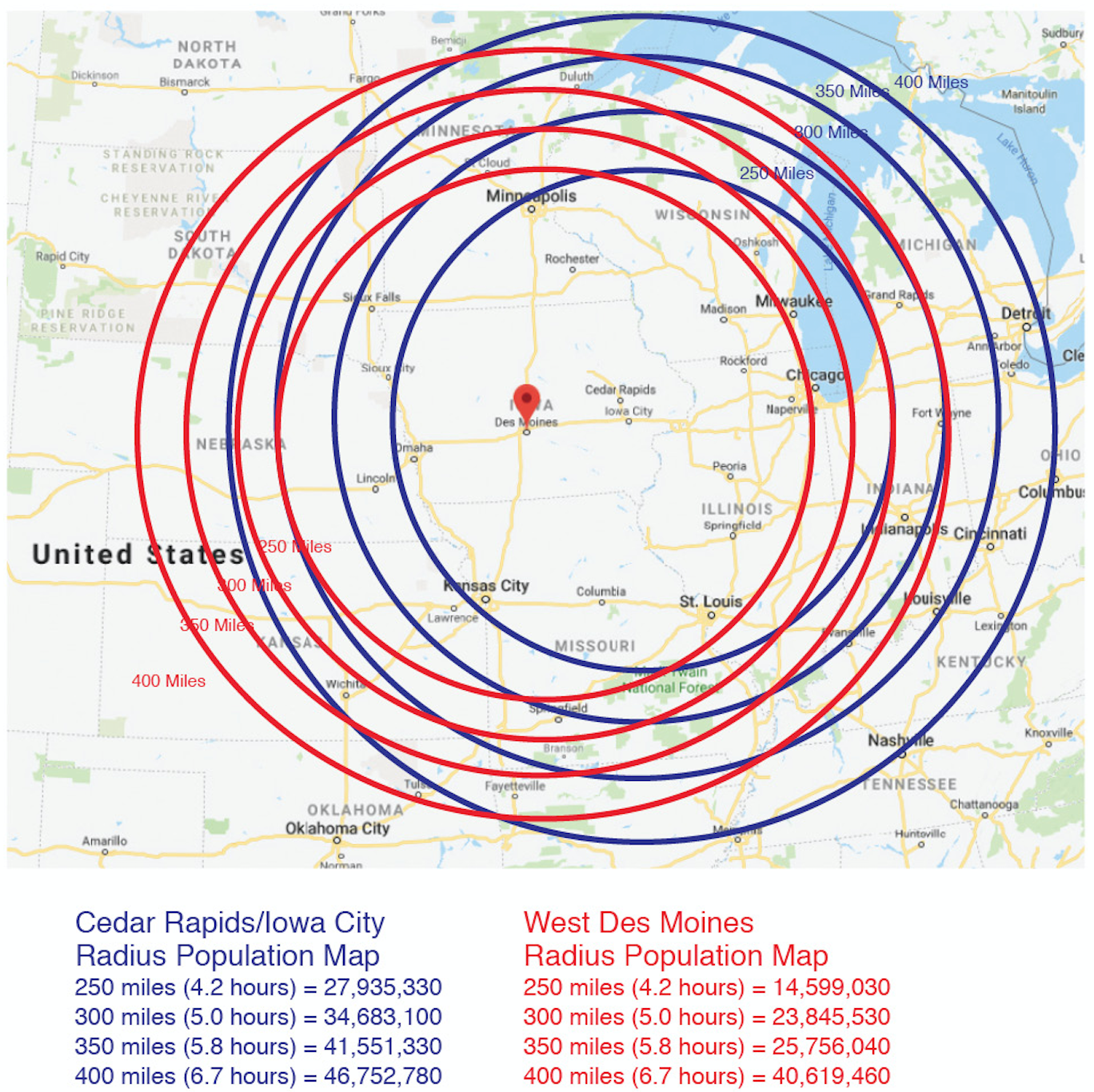

“It’s largely a function of the population density within the allowable out-and-back distance for a cargo truck driver under federal driver safety regulations,” Mr. Lenss explained. “How far can a driver go out and back in a day? It’s 300 miles, or something like that – so when you put population demographics around that DOT limit, we’re able to get to 11 million more people than you can if you’re at the I-80/I-35 corridor. The further west you go, the population density goes down quickly.”

From CID, Mr. Lenss said, carriers can make out-and-back truck deliveries to Omaha, parts of Kansas City, Des Moines, St. Louis, a good portion of Chicago, part of the Minneapolis-St. Paul metro and Wisconsin’s largest cities, Madison and Milwaukee.

Air freight patterns have been mixed at the two other regional airports that vie with CID for market share.

Quad City International Airport (MLI) has been focused on growing air cargo operations since April 2017 through its Airport Services LLC unit, which provides such services as fueling commercial airline and cargo carriers and offering ground handling equipment. It has seen continued growth since then, airport spokeswoman Cathie Rochau said. Through the first 10 months of 2018, total cargo movements, both enplaned and deplaned, are up 7 percent.

Des Moines International Airport (DSM) reported a nearly 40 percent decline in air cargo, both enplaned and deplaned, for the first nine months of 2018 compared to the same period of 2017.

“Our cargo is down for 2018 when compared to the same period in 2017 because UPS moved their second-day delivery sort from DSM to Rockford [Chicago Rockford International Airport] in July of 2017,” airport Executive Director Kevin Foley said in an email.

Air cargo movement through the Rockford airport has risen 77 percent through the first 10 months of 2018, to nearly 1.7 billion pounds, Transport Topics reported recently, as several airlines also began routing freight for Amazon through the facility.

Mr. Foley noted that cargo volumes have been on the rise again at DSM since June, and that the airport still handles about 50 percent of the air cargo volume in Iowa, more than any other airport.

Globally, air freight tonnage increased 2 percent in September, well below the five-year average increase of 5.1 percent, according to the International Air Trans- port Association.

“Weakening order books and longer delivery times are undercutting the need for air freight in many traditional markets,” IATA Director General and CEO Alexandre de Juniac said in a news release. “But there is also some positive news. For example, strong consumer confidence goes hand in hand with expanding international e-commerce trade to give air cargo a boost.”

Mr. Lenss said moving the air cargo operations at CID will free up apron space at the passenger terminal to accommodate growth in commercial passenger service, which was up 5.8 percent year-over-year through August.

Flynn Company Inc. of Dubuque will lead the cargo apron expansion project, for which ground was broken on Oct. 3. The project was made possible by a $8.8 million Federal Aviation Administration discretionary grant and $1.5 million in support from the Cedar Rapids Airport Commission.